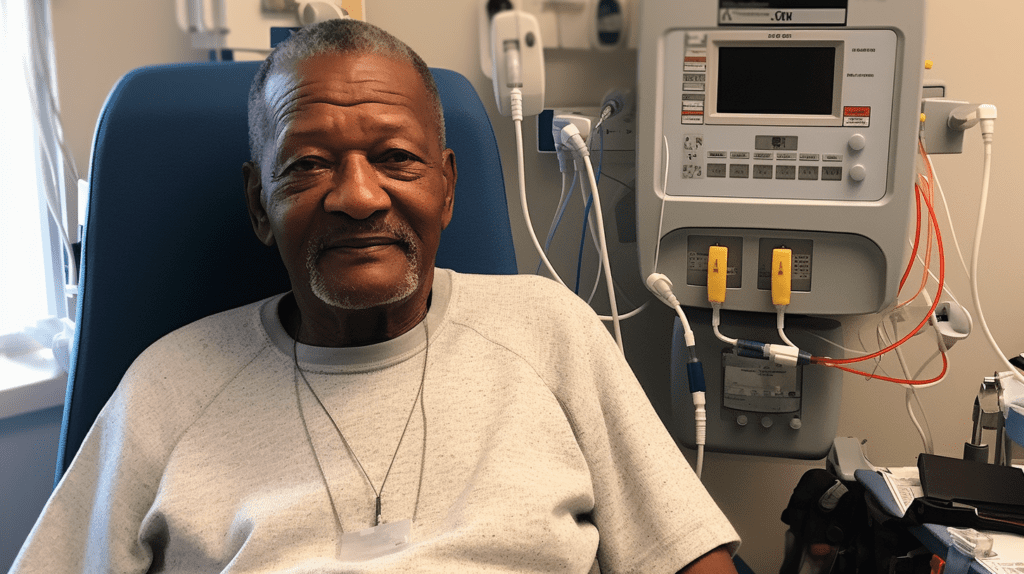

Life insurance is an essential financial planning tool designed to protect your loved ones in the event of your untimely death. However, navigating Life Insurance providers with Pre-Existing Conditions can be a daunting task. You may wonder how your condition will affect your rates, the type of policy you can obtain, and whether you will even be eligible for coverage. In this blog, we will guide you through the process of navigating life insurance with pre-existing conditions and provide you with the necessary information to make an informed decision.

- Understanding Pre-Existing Conditions

A pre-existing condition is a medical condition that you have been diagnosed with or treated for before applying for life insurance. These conditions may range from minor health issues like high blood pressure to more serious illnesses such as cancer or heart disease. Insurance companies typically take pre-existing conditions into account when determining your eligibility and premium rates, as they are considered a higher risk.

A pre-existing condition is a medical condition that you have been diagnosed with or treated for before applying for life insurance. These conditions may range from minor health issues like high blood pressure to more serious illnesses such as cancer or heart disease. Insurance companies typically take pre-existing conditions into account when determining your eligibility and premium rates, as they are considered a higher risk.

- Importance of Full Disclosure

When applying for life insurance, it’s crucial to be completely honest about your medical history, including any pre-existing conditions. If you withhold or provide false information, you risk having your policy canceled or a claim denied, leaving your loved ones without financial protection. Insurance companies have the right to access your medical records, so it’s always best to provide accurate information upfront.

- Types of Life Insurance Policies

There are various types of life insurance policies available, and understanding the differences can help you determine the best option for your needs:

a. Term Life Insurance: This type of policy offers coverage for a specific term, typically ranging from 10 to 30 years. It is usually the most affordable option, but if you have a pre-existing condition, you may face higher premiums or be denied coverage.

b. Whole Life Insurance: This policy provides coverage for your entire lifetime and includes a cash value component. While it is more expensive than term life insurance, it may be more accessible for individuals with pre-existing conditions.

c. Guaranteed Issue Life Insurance: This policy does not require a medical exam, making it an attractive option for those with pre-existing conditions. However, premiums are typically higher, and coverage amounts are often limited.

- Tips for Obtaining Life Insurance with Pre-Existing Conditionsa. Work with an Independent Insurance Agent: These professionals can help you find the best policy for your needs by comparing quotes from multiple insurers. They are well-versed in the underwriting guidelines of various companies and can help you navigate the application process.b. Improve Your Health: If possible, take steps to manage your pre-existing condition by following your doctor’s advice, maintaining a healthy lifestyle, and taking prescribed medications. This may improve your chances of obtaining coverage and potentially lower your premium rates.c. Consider Group Life Insurance: If your employer offers group life insurance, you may be eligible for coverage without needing to undergo a medical exam. This can be a valuable option for individuals with pre-existing conditions, as coverage is often guaranteed.

Navigating life insurance with a pre-existing condition can be challenging, but it’s not impossible. By understanding the types of policies available, working with an independent insurance agent, and taking steps to improve your health, you can increase your chances of securing the coverage you need. Remember, life insurance is an essential part of your financial plan, and having a pre-existing condition should not deter you from protecting your loved ones.