The Future of Life Insurance

The life insurance industry, once considered slow to change and adopt new technologies, is now embracing innovation to enhance customer experiences and streamline business processes. As new technologies continue to emerge, the landscape of life insurance is shifting rapidly. In this blog post, we will delve into some of the most promising trends and technologies […]

How to Choose the Right Life Insurance Beneficiaries

Life insurance is an important financial tool designed to protect your loved ones in the event of your passing. Choosing the right beneficiaries for your life insurance policy is a critical decision that requires careful thought and planning. In this blog post, we will discuss the factors you need to consider when selecting life insurance […]

Life Insurance for Small Business Owners

As a small business owner, you’ve put in countless hours, endless energy, and immeasurable passion into building your business. It is a labor of love and a testament to your entrepreneurial spirit. But have you considered what would happen to your business and your legacy if you were suddenly no longer there to guide it? […]

Life Insurance and Estate Planning

Life insurance and estate planning may seem like two distinct financial topics, but when strategically combined, they can create a comprehensive plan to safeguard your legacy and protect your loved ones. In this blog, we will explore the intersection of life insurance and estate planning, and how the two can work together to ensure your […]

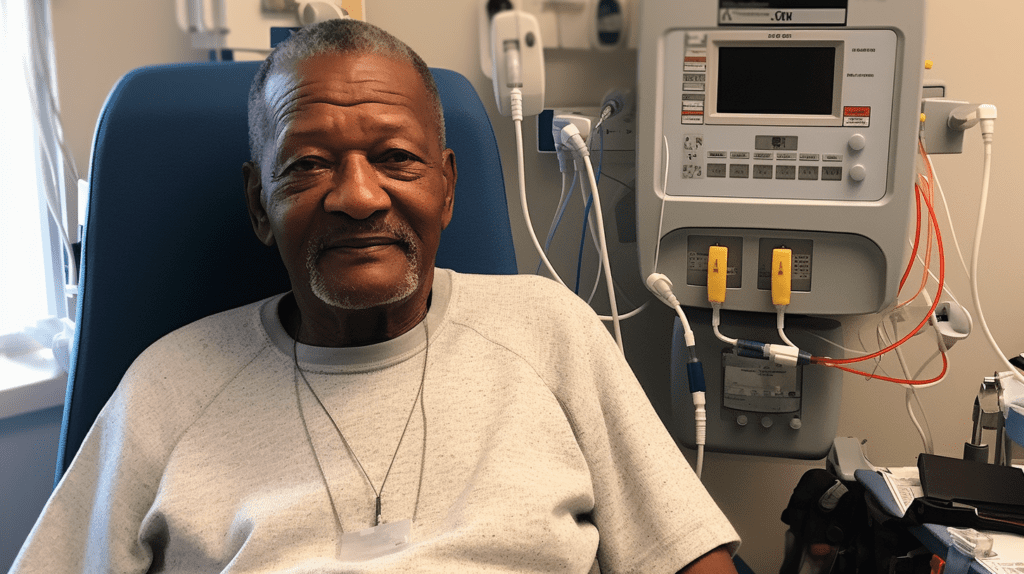

Life Insurance with Pre-Existing Conditions

Life insurance is an essential financial planning tool designed to protect your loved ones in the event of your untimely death. However, navigating Life Insurance providers with Pre-Existing Conditions can be a daunting task. You may wonder how your condition will affect your rates, the type of policy you can obtain, and whether you will […]

Life Insurance for Stay-at-Home Parents

Stay-at-home parents, often considered the backbone of the family unit, dedicate their lives to nurturing and supporting their loved ones. Despite their crucial role, stay-at-home parents are often overlooked when it comes to financial planning, particularly life insurance. This blog post aims to shed light on the importance of life insurance for stay-at-home parents and […]

Term vs. Whole Life Insurance

Term vs. Whole Life Insurance: Which One is Right for You? Life insurance is a crucial financial product that helps secure your family’s future in the event of your untimely passing. But with various types of life insurance available, how do you choose the right one for you? In this blog post, we’ll explore the […]

Life Insurance Myths Debunked

Life Insurance Myths Debunked. Life insurance is a crucial financial safety net that protects your loved ones in case of your untimely demise. However, there are numerous misconceptions surrounding life insurance that can deter people from obtaining coverage or cause confusion when selecting a policy. In this blog post, we will debunk some common life […]

Life Insurance 101

Life Insurance 101: A Comprehensive Guide for Beginners Life insurance is a crucial financial tool that provides a safety net for your loved ones in the event of your death. It helps ensure their financial stability and offers peace of mind during a challenging time. If you’re new to the world of life insurance, this […]